Building a Condo Budget that Works

Last month, we took some time here on the Catalyst blog to explore exactly why it seems like the bottom has fallen out of condo reserve fund studies here across the province in recent months. We covered some decent ground and made some good progress, but there’s a second part of that story that we didn’t get a chance to cover: annual budgets.

Luckily, we’ve got an expert in our corner to help us out. Catalyst Condo Management project manager Dustin Gutsche is joining us once again today to explore the ins and outs of annual budgets and why they’re feeling so strained lately. Without further ado, then, let’s jump right in.

A Five-Beat Condo Budget Breakdown

1. The Difference Between Budgets and Reserve Funds

Given that we’re building this budget blog off the back of our early reserve fund-focussed article treading similar ground, it seemed smart to take a moment to cover off what the heck the difference between budgets and reserve funds is, anyway.

As Gutsche detailed last time, a reserve fund is essentially a chunk of money set aside that’s meant to go towards any major upcoming repairs, projects, or building upgrades as laid out by the condo corporation’s five-year reserve fund plan.

Budgets, on the other hand, serve a bit of a different purpose. Rather than acting as a pool of funds for long-game plans or projects, a condo corporation’s annual budget instead works to cover the typical annual expenditures its costs to keep a condo community up and running.

2. That Makes Sense – So Where Are Budgets Falling Short, Then?

Now that we’re clear on what budgets are, there’s still the small detail of tackling just why it is that so many annual budgets in Alberta are falling short these days, leading to tapped-out treasuries, unexpected special levies, and more.

“The reality is that we’ve been seeing unprecedented economic fluctuations that are throwing condo budget projections way out-of-whack,” Gutsche began. “Regarding an annual budget, Alberta condo owners always want to ask, ‘Why are my condo fees going up so much? Why is my property manager doing so poorly?’ In actuality, the tough part comes through in the rising cost of pretty much everything. Take insurance, which has had a major impact on condo costs since about 2019. One property I work with has seen increases in this space by upwards of 250% compared to the cost of what things were back in 2018. How do you even begin to budget against unpredictable cost increases to that magnitude?”

Yikes. That’s a great question, Dustin – how does a condo corporation contend with those sorts of challenges? Let’s dive a little deeper.

3. Digging into The Rising Cost of Inflation

Now, we stated as much in our last blog on the subject, but it’s worth reiterating that here at Catalyst, we’re a condo management company and not a trained team of statisticians. We also don’t have access to any data but that collected through our own business working with a select sampling of Alberta-based condo communities and corporations – so, take that caveat for what it’s worth.

All that being said, however, the numbers we do have access sure seem to tell a pretty clear story to us.

Citations

Alberta Insurance Rates: https://rates.ca/insurance-quotes/home/alberta#home-alberta-trends

Building Construction Price Index: https://www150.statcan.gc.ca/t1/tbl1/en/tv.action?pid=1810013502

Consumer Price Index: https://www.statista.com/statistics/271247/inflation-rate-in-canada/

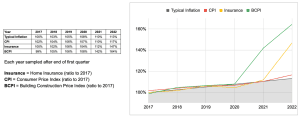

“A big part of the problem is inflation,” Gutsche acknowledged. “When building a budget, condo boards take inflation into account – but they typically tend to work with the 2.5% inflationary figure annually estimated as a consumer price index. Unfortunately, inflation has risen far above the typical 2.5% rate – plus, with what we’ve been seeing since the start of COVID, other categories have just gone completely anomalous. Supply chain issues, business shutdowns, etc. have really thrown things for a loop.”

Well, that’s certainly a helpful explanation as to what’s going on – but what can condo corporations do about it? We’ll get to that in a moment – but we want to quickly touch on what not to do first.

4. Budgeting Pitfalls to Avoid

When it comes right down to brass tacks, condo boards have a fiduciary obligation to balance the budget – that, along with properly funding the reserve fund, are really their two sole obligations. The one thing condo boards cannot do, Gutsche cautioned, is simply ignore what’s happening.

“To just duck their heads in the sand and pretend things are fine will eventually lead a condo board to a tough spot where they have to force a cash call from owners in the form of special levies or condo fee increases,” Gutsche warned. “Now, there are lots of good reasons not to increase condo fees or introduce a special levy, and one way to help balance the budget is to bring down costs – but at some point, the only thing to do is increase the amount of money coming in, and that’s the milestone a lot of corporations are starting to hit right about now.

5. What Should Condo Boards Do, Then?

Simply ignoring the problem of unbalanced budgets isn’t an option – so what should condo boards do in the face of rising costs and flagged budgets, then?

“There’s no real silver bullet here, unfortunately,” Gutsche admitted, “but a little bit of extra planning can certainly go a long way.

“When you’re developing a budget, make a realistic expectation on what you’ll inflate your budget by based on market modifiers. Then, for more unpredictable things like insurance, the best thing you can do is change your insurance policy so that it expires right before your budget planning season, giving you time to incorporate any changes into your new budget, giving you back more control.

“Consider, also, costs like waste removal and associated surcharges where clauses allow for massive overnight increases and try to anticipate them. Be familiar with your contracts, know what to expect, and try to plan accordingly.”

Thanks as always for the advice and guidance today, Dustin Gutsche. It couldn’t be more appreciated! To learn more about ensuring your condo’s set up for budgeting success, give us a call at Catalyst Condo Management today – we’ll be happy to help steer you (and your condo’s budget) in the right direction!